high iv stocks barchart

Scan for Stock and ETF Iimplied Volatility IV IV Rank and IV Percentile by clicking the table header or the filter button to the right. Stock and ETF Implied Volatility Screener.

Watchlist Option Alpha Option Trading Implied Volatility Ishares

This suggests a possible upside of 335 from the stocks current price.

. The really unique feature of Barcharts stocks screener is its proprietary. Stock IV Rank and IV Percentile. This rank shows how low or high the current implied volatility is compared to where it has been at different times in the past.

This rank shows how low or high the current implied volatility is compared to where it has been at different times in the past. IV Rank 50 to 100 VS IV Rank 0 to 50 Our back test reveals that there is no advantage to selling credit spreads when IV Rank is above 50. ABX 56.

VolDex Implied Volatility Indexes. High IV or Implied Volatility affects the prices of options and can cause them to swing more than even the underlying stock. High Implied Volatility Call Options 26052022.

IDFC First Bank Ltd. At Yahoo Finance you get free stock quotes up-to-date news portfolio management resources international market data social interaction and mortgage rates. About Churchill Capital Corp IV.

A stock with a high IV is expected to jump in price more than a stock with a lower IV over the. To find company with good fundamentals Im using Barchart stock screener to filter for medium to large size companies with stock price greater then 20 and have high growth rates. Barchart Is User Friendly.

And price is between 10 and 100. 1-Month 3-Month 6-Month 52-Week Year-to-Date 2-Year 3-Year 5-Year 10-Year 20-Year All-Time. Adani Ports Special Economic Z.

Interestingly if I want to screen for high IV Rank those filters are in the stock screener instead of the options screener. For Canadian market an option needs to have volume of greater than 25 open interest greater than 1 and implied volatility greater than 60. The stocks volatility for the past 20 days and the past 1 year is based on the stocks actual price movements.

In-depth coverage on all symbols including charts technicals fundamentals opinions is available at your fingertips on our advanced multiple Favorites lists making it easy for. Naturally we are coming into earnings season here so theres a reason that some of these have high IV here eg NFLX announces in a week and a half. As an example say you have six readings for implied volatility which are 10 14 19 22 26 and 30.

Main View Technical Performance Fundamental Custom. Their forecasts range from 5600 to 9000. To make these lists a stock must be trading under 1000 have a positive or negative 52-week percent.

Ordinarily I like IV to be 50 and IVR current IVs level relative to where its been for the past 52 weeks to be high too but I may not find a great deal of 70. What is considered to be a high Implied Volatility Percent Rank. 2005 to 2015 back tested to compare performance.

Mon Apr 18th 2022. Stocks by Sector. All US Exchanges NYSE NYSE Arca AMEX Nasdaq OTC-US ETFs Large Cap Mid Cap Small Cap Micro Cap Price 10 Price 10 Volume 100000 Volume 100000.

It intends to effect a merger capital stock exchange asset acquisition stock purchase reorganization or similar business combination with one or more businesses. Ad Were all about helping you get more from your money. Track stocks futures forex markets ETFs indices.

Breakdown of Trades This table breaks down the average winners and losers per IV Rank. Trade stocks bonds options ETFs and mutual funds all in one easy-to-manage account. Show stocks where the average day range 50 is above 5.

Just like it sounds implied volatility represents how much the market anticipates that a stock will move or be volatile. The company was incorporated in 2020 and is based in New York New York. Youve just calculated the current implied volatility and it is 10.

May 8 2022 May 8 2022 Comments Off on rivian stock options barchart. If youre on StockFetcher click New Filter and copy and paste the following lines into the pale-yellow area. In this example it would be given a rank of 0.

Gujarat Narmada Valley Fertilize. Barchart Stocks Futures and Forex is the most complete financial app currently available. Gujarat Narmada Valley Fertilize.

A measure of option cost and implied volatility. IV Rank from 0 50 tested. View stocks with Elevated or Subdued implied volatility IV relative to historical levels.

Stocks priced under 10 can represent an affordable asset to add to your portfolio. Top Stocks Under 10. Lets get started today.

Interestingly if I want to screen for high IV Rank those filters are in the stock screener instead of the options screener. Gujarat Narmada Valley Fertilize. As a result the settings are much like youd expect.

Wed Apr 27th 2022. In contrast the implied volatility is derived from options. View analysts price targets for II-VI or view top-rated stocks among Wall Street analysts.

According to the research report the global non-PVC IV bags market size share was valued at USD 153 billion in 2020 and is expected to reach USD 319 Billion By 2028 to grow at a CAGR of 99 during the forecast period. Your typical settings like volume moving averages and RSI are all there. IV Rank from 50 100 tested.

The VolDex Implied Volatility Indexes generally refers to. The real beauty of the Barchart stocks screener is that its very user-friendly for new or experienced users. On average they anticipate II-VIs stock price to reach 8083 in the next twelve months.

Shows Stocks ETFs and Indices with the most option activity on the day with the ATM average IV Rank and IV Percentile. Highs Lows Summary. Options information is delayed a minimum of 15 minutes and is updated at least once every 15.

Top 1 Signal Strength. A green implied volatility means it is increasing compared to yesterday and a red implied volatility means it is decreasing compared to yesterday. We also show only options with days till expiration greater than 14.

Sun May 8th 2022. To search for stocks that routinely display high volatility and heavy trading volumes go to StockFetcher or another screener of your choice. Main View Technical Performance Fundamental Custom.

Barchart Stocks Futures and Forex is the most complete financial app currently available. Churchill Capital Corp IV does not have significant operations. Non-PVC IV Bags Market Size Expected to be Worth 319 Billion By 2028 at 99 CAGR.

High Implied Volatility Call Options 30062022. Use this page to find the top and bottom performing stocks under 10 updating throughout the trading day.

Non Verbal Reasoning Puzzles For Kids And Teens With Answers Brain Teasers For Kids Brain Teasers Fun Worksheets For Kids

Using Barchart Tools To Find Interesting Stocks Barchart Com

Modern Chart Microsoft Word Resume Template By Inkpower On Etsy 12 00 Microsoft Word Resume Template Name Card Design Resume Design

Tastytrade On Twitter Options Trading Strategies Stock Chart Patterns Implied Volatility

Apac Is Projected To Be The Fastest Growing Modular Chillers Market Marketing Apac Modular

Electrochemical Metal Series Teaching Chemistry Chemistry Lessons Chemistry Education

Us 10 Years Note And Bond Approaching Support Elliott Wave Analysis

12 Gantt Chart Examples You Ll Want To Copy Gantt Chart Gantt Timeline Design

Relationships Campus Network For High Availability Design Guide Cisco Design Guide Networking Campus

Pin On Pin 10 Web Best Practices

Iv Rank Vs Iv Percentile Which Is Better Measuring Implied Volatility Youtube

Grade Contained Gold Relationship For The Top 10 Highest Grade Open Pit Mines Gold Mining Mining Open Pit Mine

Photoshop Tutorial Graphic Design Infographic Cylinder Graphic Design Tutorials Photoshop Graphic Design Infographic Infographic

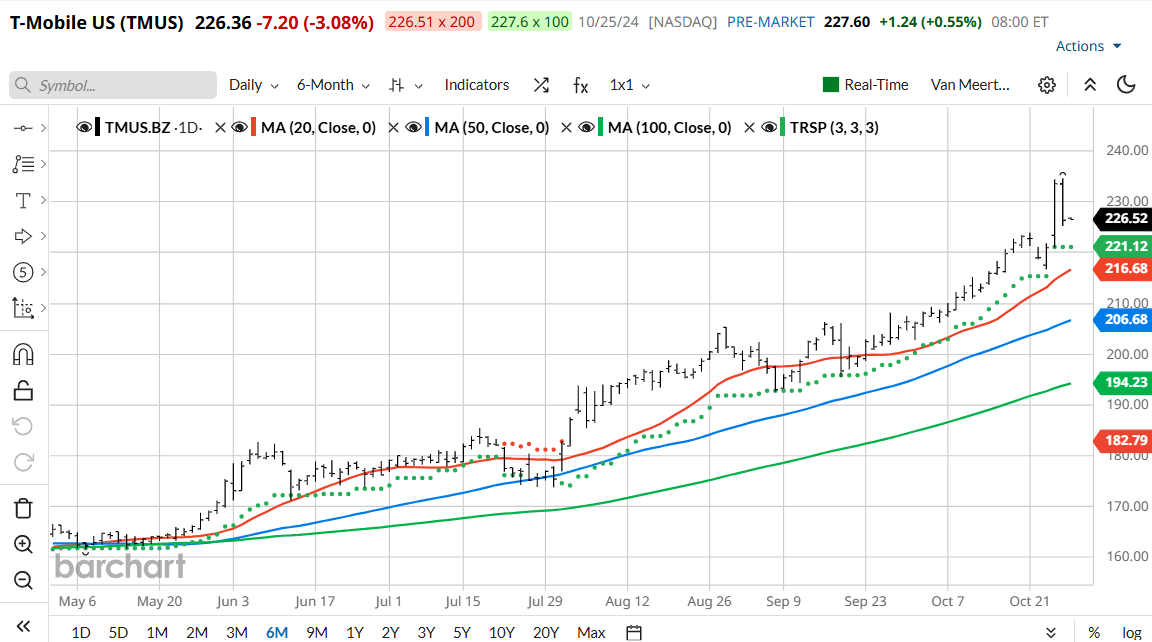

Highest High Lowest Low Barchart Com

Most Popular Paradox Interactive Game By Country Data Interestingdata Beautifuldata Visualdata Paradox Interactive Map Information Visualization